Top 5 private banks in India

Here are detailed profiles of the top 5 private sector banks in India (based on size, market-cap, branch/ATM reach and overall prominence). These are all major players in the Indian banking system.

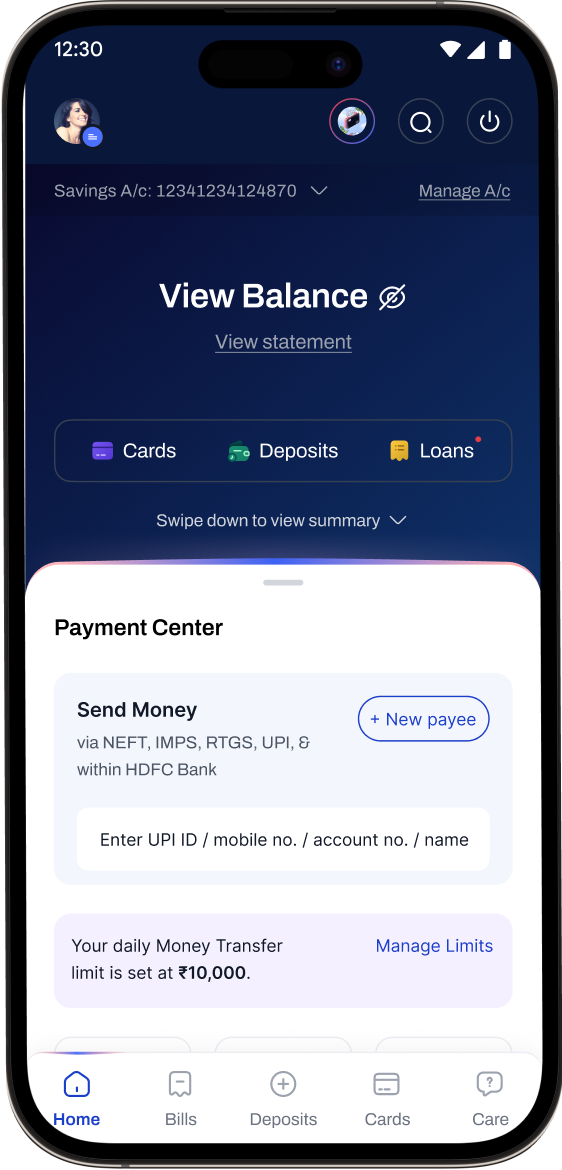

1. HDFC Bank Ltd.

Overview

- Founded: August 1994; commenced operations January 1995. (HDFC Bank)

- Headquarters: Mumbai, Maharashtra, India. (Wikipedia)

- Present network: As of 30 June 2025, ~9,499 branches and ~21,251 ATMs across ~4,153 cities/towns. ~51 % of branches in semi-urban/rural areas. (HDFC Bank)

- Position: India’s largest private sector bank by assets and market capitalisation. (Wikipedia)

Key strengths

- Wide retail & wholesale business, strong branch reach, and very large deposit and loan book.

- Good digital infrastructure (net-banking, mobile banking, etc).

- Strong brand, large scale gives advantage in many segments (e.g., credit cards, retail loans).

Points to note / risks

- With very large size comes complexity & regulatory scrutiny.

- Even large banks have to manage non-performing assets (NPAs), regulatory compliance, and digital/operational risks.

- High expectations: performance needs to remain strong to justify size and leadership.

Quick snapshot

- Business model: Retail banking, corporate banking, cards, home loans, wealth, etc.

- Outlook: Well-placed for India’s retail growth, but must keep cost of funds, asset quality and technology risk under control.

2. ICICI Bank Ltd.

Overview

- Founded: The predecessor ICICI bank activities date earlier; as a commercial bank it is in the private sector. (Wikipedia)

- Headquarters: Mumbai, Maharashtra (registered office in Vadodara, Gujarat). (Wikipedia)

- Network: ~6,983 branches and ~16,285 ATMs (according to one source) across India. (ICICI Bank)

- Assets: Total assets around ₹26.42 trillion as of March 2025. (ICICI Bank)

Key strengths

- Strong in both retail and corporate banking.

- International presence via branches/subsidiaries. (ICICI Bank)

- Well-recognised brand, large customer base.

Points to note / risks

- As with all large banks, managing asset quality (especially with any macro-stress) is important.

- Competitive environment with other major private banks increasing capability.

- Digital and regulatory risks always present with large scale.

Quick snapshot

- Business model: Full spectrum (retail banking, corporates, institutional, international operations).

- Outlook: Strong foundationally; growth depends on maintaining operational excellence and keeping non-performing assets low.

3. Kotak Mahindra Bank Ltd.

Overview

- Founded: The banking licence was granted in 2003 (though the parent finance business goes back much further). (Pocketful.in)

- Headquarters: Mumbai, Maharashtra, India. (Wikipedia)

- Scope: Offers consumer banking, commercial banking, investment banking, insurance, asset management, wealth management. (Wikipedia)

Key strengths

- Strong in innovation/digital — e.g., introduced “811” zero-balance digital account earlier. (Factsgem)

- Broad product suite and growing presence.

- Good recognition and brand in mid/high-end segments.

Points to note / risks

- Regulatory attention: E.g., in 2024 the Reserve Bank of India (RBI) barred Kotak from onboarding new digital customers and issuing new credit cards (due to IT & risk governance shortcomings). (Financial Times)

- Growing size requires operational rigour (IT, risk, compliance).

- Competition from ultra-large banks and challenger banks.

Quick snapshot

- Business model: Mixture of retail + wholesale + full-service financial offerings.

- Outlook: Strong growth potential, especially in digital, but making sure risk/governance keep pace is important.

4. Axis Bank Ltd.

Overview

- Founded: As UTI Bank in 1993 (under banking licence), later renamed Axis Bank. (Wikipedia)

- Headquarters: Mumbai, Maharashtra, India. (Axis Bank)

- Network: As of March 31, 2025 – 5,876 branches and 13,941 ATMs/cash-recyclers; ~47 % of branches in rural/semi-urban areas. (Axis Bank)

Key strengths

- A major player with strong retail and corporate business.

- Good branch/ATM spread including outside major metros.

- Positioned to cater for India’s semi-urban/rural growth as well as urban.

Points to note / risks

- As competitive pressures mount, need to maintain margin, service, asset quality.

- Operational efficiency and cost of funds are important issues in a large bank.

- With a broad network, branch productivity and digital adoption are important to sustain competitiveness.

Quick snapshot

- Business model: Retail banking, corporate banking, investment banking services, cards, digital banking.

- Outlook: Should benefit from broader India growth; still must stay agile relative to more nimble competitors.

5. IndusInd Bank Ltd.

Overview

- Founded: April 1994 (among the first of the new-generation private banks in India). (hindujagroup.com)

- Headquarters: Mumbai/India (though some sources say originally promoted by Hinduja Group). (Wikipedia)

- Network: ~3,081 branches and ~3,027 ATMs across India (as of latest data). (Wikipedia)

- Customer base: ~42 million customers (as per March 2024). (indus-ind)

Key strengths

- Strong in retail and SME segments; emphasizes digital banking. (indus-ind)

- Has international representative offices (London, Dubai, Abu Dhabi) for NRI/business banking. (hindujagroup.com)

Points to note / risks

- Has recently faced major challenges: e.g., reported largest-ever quarterly loss due to accounting/derivative issues in March 2025. (Reuters)

- These issues raise concerns about risk management and operational controls.

- For customers/investors, these downside risks are meaningful despite growth potential.

Quick snapshot

- Business model: retail banking, SME, corporate, vehicle financing, microfinance, wealth.

- Outlook: Growth prospects remain strong (India’s economy & credit demand), but risk/control profile must improve.

Additional Notes

- The banking sector in India is regulated by the RBI. Large private banks also have to maintain capital buffers, asset-quality norms, risk management and IT/infrastructure resilience.

- When choosing a bank (for account/loan/investment), besides brand and network one should also check service levels, branch/ATM convenience for you, digital offerings, transparency of fees and interest rates, and recent health of the bank.

- For investors, large private banks offer exposure to India’s credit/consumption growth but come with regulatory, credit-risk and margin-pressure risks.

If you like, I can provide a table comparing these five banks across key metrics (branches & ATMs, assets, deposits, loan book, capital adequacy, NPAs, etc.) and also list the next tier of private banks (banks ranked 6-10). Would you like that?